A Guide for Understanding Portfolio Management Services

Portfolio Management Services (PMS) is a sophisticated investment management service tailored to meet the needs of high-net-worth individuals (HNIs) and institutions.

PMS provides professional management of portfolios, aimed at delivering personalized solutions based on the financial goals, Risk Tolerance, and investment horizon of the client. The assets managed under PMS typically include stocks, bonds, and other financial instruments, with the objective of maximizing returns while managing risk.

Unlike mutual funds, where the investment is pooled together from multiple investors, PMS offers a more customized approach. Each portfolio is created and managed based on the investor’s unique financial situation.

Types of Portfolio Management Services (PMS)

There are three main types of PMS, each offering different levels of involvement and customization:

1. Discretionary PMS

In this type, the Portfolio Manager has full authority to make decisions regarding the investment, including asset selection and allocation, without requiring prior approval from the investor. This is ideal for investors who prefer to delegate decision-making to professionals.

2. Non-Discretionary PMS

Here, the portfolio manager provides investment recommendations, but the final decision rests with the investor. This type is suited for those who prefer to have more control over their investments while still benefiting from expert guidance.

3. Advisory PMS

In advisory PMS, the portfolio manager gives investment advice, but all transactions are executed by the investor. This type is ideal for individuals who want professional advice but wish to retain full control over their portfolio.

Who Should Consider PMS?

PMS is primarily designed for high-net-worth individuals (HNIs) and institutions who require personalized and professional portfolio management. It is suitable for:

- Investors with a higher investible surplus (generally INR 50 lakhs and above).

- Individuals looking for a customized investment approach.

- Those who seek to diversify their investment across different asset classes.

- Investors who prefer a more active, hands-on approach to portfolio management.

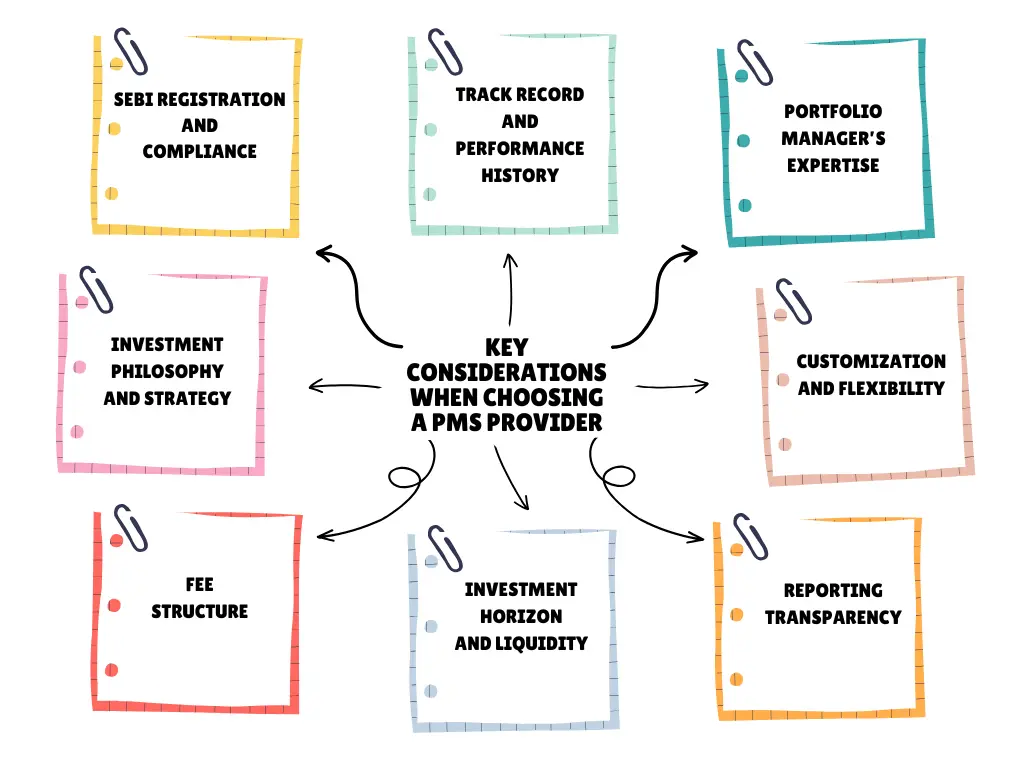

Key Considerations When Choosing a PMS Provider

Selecting the right Portfolio Management Services (PMS) provider is crucial for achieving your financial goals. Here are some key factors to consider when choosing a PMS provider:

1. SEBI Registration and Compliance

Ensure that the PMS provider is registered with the Securities and Exchange Board of India (SEBI) and adheres to all regulatory guidelines. SEBI registration guarantees a certain level of transparency, accountability, and investor protection.

2. Track Record and Performance History

Evaluate the provider’s historical performance over different market cycles. It’s important to look for consistency in returns, not just recent short-term performance. Compare the PMS’s returns against relevant benchmarks and peer portfolios to assess how well the provider manages various market conditions.

3. Portfolio Manager’s Expertise

The experience, qualifications, and reputation of the portfolio manager are critical. A seasoned portfolio manager with deep market knowledge and a proven track record of success can make a significant difference in the performance of your portfolio. Consider their investment philosophy and approach to risk management.

4. Investment Philosophy and Strategy

Different PMS providers adopt different investment philosophies and strategies, ranging from Value Investing to growth-oriented or sector-specific approaches. Make sure the provider’s investment style aligns with your financial goals, risk appetite, and Time Horizon.

5. Customization and Flexibility

One of the main benefits of PMS is the ability to customize your portfolio. Check if the provider offers tailored solutions based on your preferences, such as specific industries, Asset Allocation, or risk management strategies. Flexibility in adjusting the portfolio as per your changing financial needs is also important.

6. Fee Structure

PMS typically involves higher fees than mutual funds. Ensure you fully understand the fee structure, which generally includes management fees, entry/exit loads, and sometimes performance-based fees. Compare the fee structures of various providers to see which offers the best value relative to their services and track record.

7. Investment Horizon and Liquidity

Consider whether the PMS strategy aligns with your investment horizon. PMS is typically more suitable for long-term investments, but liquidity can vary across portfolios. Check for any lock-in periods, withdrawal policies, and the provider’s ability to meet liquidity requirements without incurring penalties.

8. Reporting Transparency

Transparency in reporting is essential for monitoring the performance of your investments. Look for providers who offer regular, comprehensive reports that include details of portfolio Holdings, transactions, performance metrics, and fees. Online platforms that allow real-time tracking are a bonus.

Advantages of PMS

1. Customization

PMS offers a tailored approach to meet the unique financial goals and risk appetite of each investor. Unlike mutual funds, PMS accounts are managed individually.

2. Professional Expertise

The portfolios are managed by experienced professionals who have a deep understanding of markets and investment strategies.

3. Transparency

PMS provides complete transparency with regular reporting of portfolio performance, transactions, and fees. Investors have full visibility into how their funds are being managed.

4. Flexibility

PMS offers flexibility in terms of investment strategies and asset selection. Investors can choose to invest in a wide range of asset classes, including Equities, debt, and structured products.

5. Tax Efficiency

Since PMS allows for individual account management, investors may be able to optimize their tax liability by timing their investments and withdrawals.

Disadvantages of PMS

1. High Minimum Investment

The minimum investment required for PMS is significantly higher than that for mutual funds, making it less accessible for small investors.

2. Cost

PMS fees are typically higher than those for mutual funds. In addition to management fees, there could be performance-based fees, which may reduce overall returns.

3. Concentration Risk

While PMS allows for customization, this could sometimes lead to a concentration of investments in fewer stocks or sectors, thereby increasing risk.

4. Lock-in Periods

Some PMS products may come with a lock-in period, reducing liquidity for the investor.

PMS vs. Mutual Funds: Key Differences

While both PMS and mutual funds aim to generate returns by investing in a basket of securities, there are several key differences between the two:

- Investment Amount: PMS requires a higher minimum investment compared to mutual funds.

- Customization: PMS offers tailored solutions, while mutual funds have a one-size-fits-all approach.

- Management Style: In PMS, the portfolio is managed individually, while Mutual Fund assets are pooled together from multiple investors.

Regulation of PMS in India

Portfolio Management Services in India are regulated by the Securities and Exchange Board of India (SEBI). SEBI has stringent guidelines to ensure that portfolio managers act in the best interest of their clients, providing transparency in fees, performance reporting, and the overall investment process.

Who Can Offer PMS?

Only SEBI-registered entities such as Wealth management firms, banks, and financial advisors are authorized to offer PMS. As a client, it is crucial to choose a portfolio manager who is not only experienced but also aligned with your investment goals.

Is PMS Right for You?

PMS is not suitable for everyone. While it provides several advantages, it is best suited for investors with a significant corpus who are seeking personalized portfolio management. It’s important to assess your financial goals, risk appetite, and investment horizon before opting for PMS.

Conclusion

Portfolio Management Services (PMS) offers a high level of customization, professional management, and flexibility. While it is a Premium service designed for HNIs, it can be a valuable tool for those looking to actively manage their wealth with the help of experienced professionals. However, like any investment service, it’s important to weigh the benefits against the costs and risks involved before making a decision.

Disclaimer: The content on this blog is intended solely for educational purposes. All investment and financial planning strategies discussed are subject to market conditions and other factors beyond our control. Any securities or investments mentioned are not to be taken as recommendations or endorsements. Readers are encouraged to consult with a qualified Financial Advisor before making any investment decisions.