Understanding how your investments perform is crucial to achieving financial success. The Internal Rate of Return (IRR) is a powerful metric that helps you evaluate and compare the growth potential of different investments.

With our comprehensive IRR Calculator, you can easily measure the profitability of your investments, allowing you to make informed decisions and optimize your financial strategy.

IRR Calculator

General IRR Calculator

Return Multiple IRR Calculator

Fixed Cash Flow IRR Calculator

In the final period, along with my periodic cash flow

I shall receive my initial investment

Custom Cash Flows IRR Calculator

| Enter your yearly cash flows: | ||

₹

| ||

₹

| ||

₹

| ||

₹

|

What is an IRR Calculator?

An Internal Rate of Return (IRR) Calculator is a financial tool used to measure the profitability of investments or projects. IRR represents the rate of growth an investment is expected to generate annually. In essence, it’s the discount rate that makes the net present value (NPV) of all cash flows from a particular investment equal to zero.

Whether you’re investing in mutual funds, stocks, or any other Asset Class, calculating IRR helps in understanding how well your investment has performed over time.

How Can an IRR Return Calculator Help You?

An IRR Calculator aids investors in determining the annual growth rate of an investment considering multiple cash inflows and outflows. It helps:

- Evaluate Investment Performance: You can compare different investments based on their IRR, making informed decisions on where to allocate funds.

- Assess Project Feasibility: If you are considering a business project or investment, IRR helps you determine if the returns justify the risks.

- Compare Returns: You can benchmark the IRR against a required rate of return or cost of capital to decide if an investment meets your return objectives.

How Do IRR Calculators Work?

An IRR calculator estimates the internal rate of return by analyzing all the cash flows (inflows and outflows) and determining the discount rate that sets the NPV to zero. This discount rate reflects the efficiency or profitability of your investment.

The key idea is to measure the returns in percentage form, giving you a clear picture of your investment’s overall performance. With different Options like General IRR, Return Multiple, Fixed Cash Flows, and Custom Cash Flows, IRR calculators allow you to choose the calculation method that suits your needs.

IRR Calculation Formula

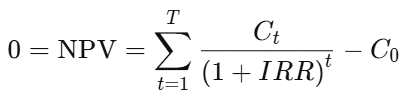

The IRR is calculated by solving the equation where the Net Present Value (NPV) is zero:

Where:

- C0 is the initial investment (a negative value indicating cash outflow).

- Ct represents the net cash inflow during the period t.

- t is the number of time periods.

- IRR is the Internal Rate of Return.

Finding IRR manually can be tedious, which is why an online IRR calculator like ours simplifies the process.

You can also calculate XIRR from our XIRR Calculator.

Example of an IRR Calculator

Scenario: Let’s assume you made an initial investment of ₹1,00,000. After two years, the value of your investment grew to ₹1,50,000. Using a General IRR calculation:

- Initial Investment: ₹1,00,000

- Final Value: ₹1,50,000

- Time Period: 2 Years

The IRR calculated for this investment will be around 22.47%. This means your investment grew at a rate of 22.47% per annum over the 2-year period.

How to Use Trustwell Finsol’s IRR Calculator?

Our IRR calculator is designed to be user-friendly, catering to various scenarios. Here’s a step-by-step guide to using it:

- General IRR: Enter your initial investment, the final value, and the time period in years and months. Click Calculate IRR to find your annual return rate.

- Return Multiple: Enter the multiple by which your investment has grown and the duration. Get the IRR instantly.

- Fixed Cash Flows: Provide your initial investment, expected cash flow amount, frequency, and duration. The calculator will consider the final cash flow return and provide the IRR.

- Custom Cash Flows: Input your initial investment and specify individual cash flows, marking them as inflows or outflows. You can add or delete rows as needed.

Advantages of Using Trustwell Finsol’s IRR Calculator

- Simplicity and Accuracy: Our calculator is easy to use, with each step guiding you through the process.

- Customizability: Whether you want a simple IRR or a more complex cash flow-based calculation, our tool has you covered.

- Versatile Applications: The calculator supports different investment types, return multiples, and cash flow patterns, making it versatile for various financial scenarios.

- Instant Results: Get results instantly without dealing with complex formulas or calculations.

- Decision-Making Aid: Provides a clearer understanding of different investment options to facilitate better decision-making.

- Time-Saving: Saves time by performing complex calculations in seconds, letting you focus on strategizing rather than number crunching.

- Benchmarking and Analysis: Allows you to compare returns across different investment types and time periods easily.

Conclusion

The IRR Calculator on our blog is an all-in-one solution to evaluate investment returns efficiently. Whether you’re a seasoned investor or a beginner, understanding IRR can greatly improve your investment decisions. Use our tool to explore your investments and plan your financial future confidently!

You can also calculate EMI from our EMI Calculator.

Disclaimer: The content on this blog is intended solely for educational purposes. The results produced by the calculator or calculators are merely indicative and intended for informational reasons.

Under no circumstances should these calculators be regarded as financial, Investment or professional advice from Trustwell Finsol (“TWF”), nor are they intended to offer users certified results from TWF or to act as an obligation, guarantee, warranty, undertaking, or commitment. They are only instruments to assist users in analyzing different illustrative situations according to the information they enter. These calculators are used at the user’s own risk, and TWF assumes no liability for any mistakes, inaccuracies, or results that may result from using them.